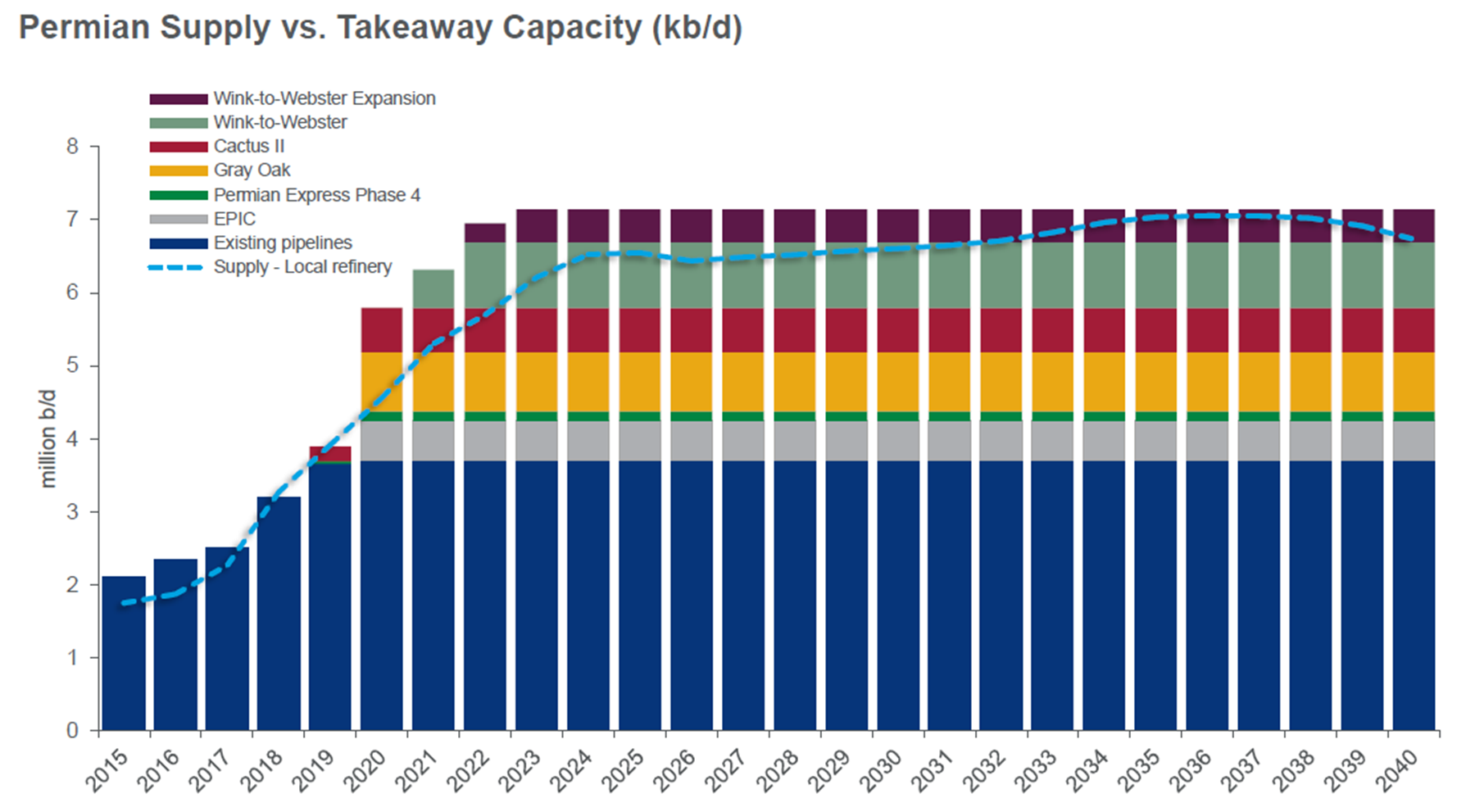

The US is in the midst of a massive crude pipeline and infrastructure buildout. As shale oil output quickly overwhelmed Permian basin crude pipeline takeaway capacity in early 2018, Permian producers' prices suffered.

As the hottest production growth region in the US Lower 48 space, the Permian basin has been the focus midstream companies seeking to develop large growth projects.

Within the last two years, seven major long-haul projects were proposed, with four ultimately reaching FID. However, FIDs did not come soon enough.

Pipeline basin crude pipeline capacity became insufficient in early 2018. This lead to significant pricing blowouts for Midland prices vs. other US benchmarks. The scramble is currently on to ensure projects under construction arrive in time to support continued production growth.

The early 2020s will see a massive build-out in a short period of time – Wood Mackenzie estimates more than 3.5 million b/d of Permian-to-Gulf Coast crude takeaway capacity by the end of 2022, effectively doubling long-haul capacity from the basin. This burst of buildout will likely lead to overcapacity short term.

A key question remains for long-term planning – will additional pipeline capacity ever be called on again, or is the build-out complete?

Permian basin crude pipeline overbuild: only temporary

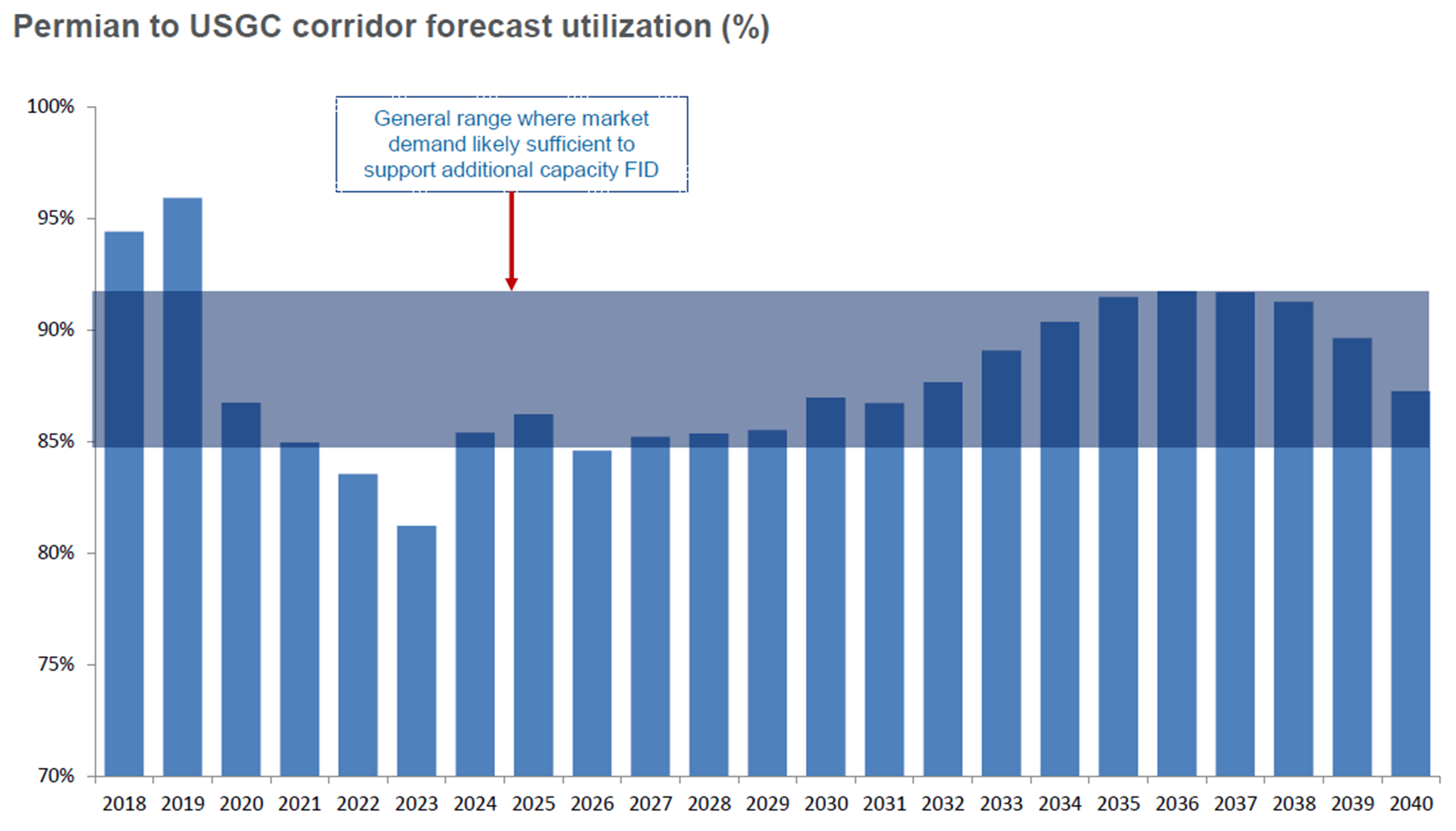

The latest Wood Mackenzie North America Crude Markets Service long-term outlook shows us that even with the rapid buildout in the early 2020s, there will be one more call for additional Permian to USGC pipeline capacity. Wood Mackenzie's analysis shows at least 300,000-500,000 b/d of crude takeaway capacity will be needed. Based on forecast market demand, an FID on the next needed pipeline may come in the late 2020s.

Here are 3 reasons to back up the market call.

1. Resilient Permian basin oil production continues into the 2030s

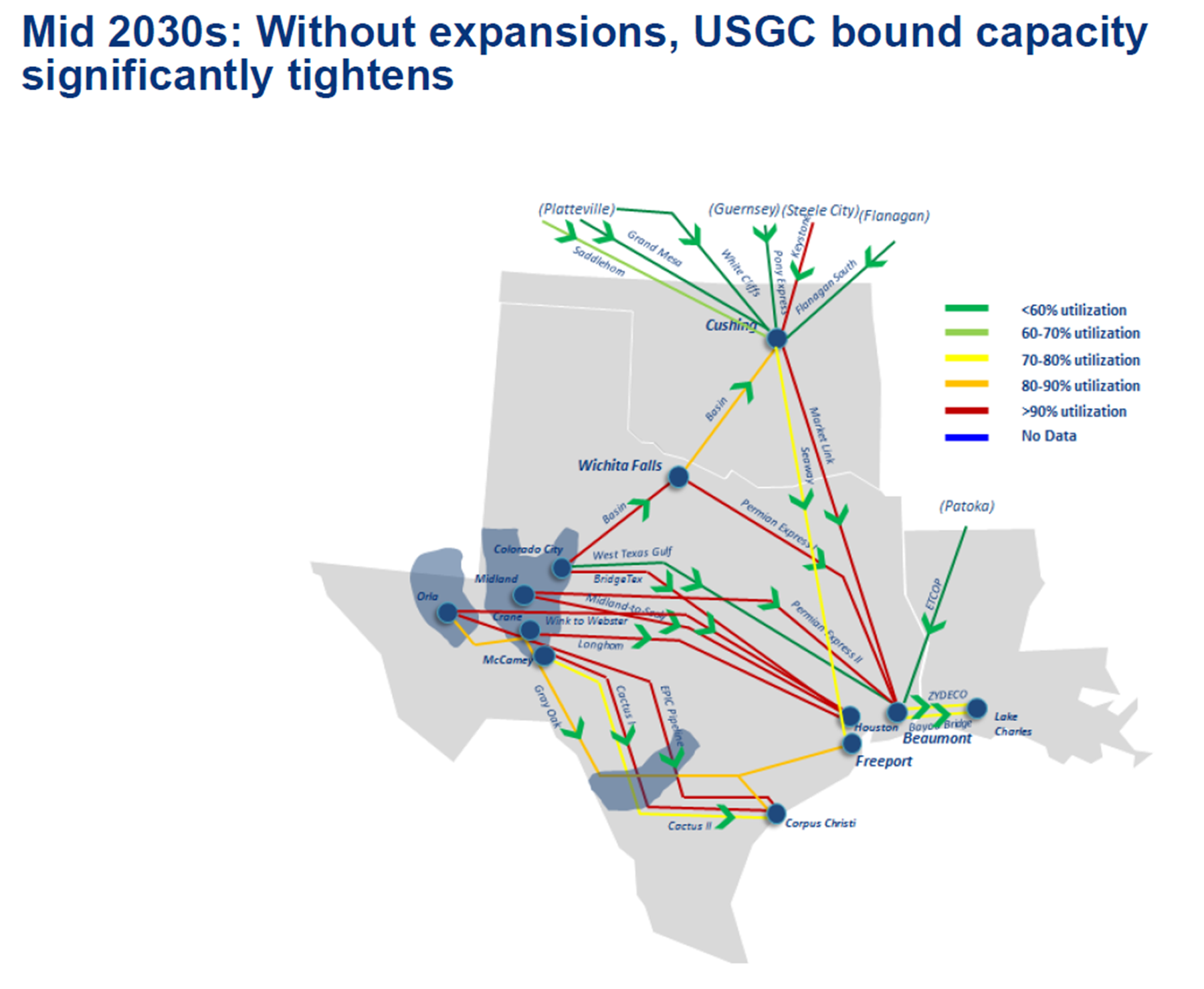

By the mid 2030s, Permian-to-Gulf Coast pipeline utilization surpasses 92%. Wood Mackenzie believes this high rate will necessitate additional pipeline expansions, or greenfield capacity.

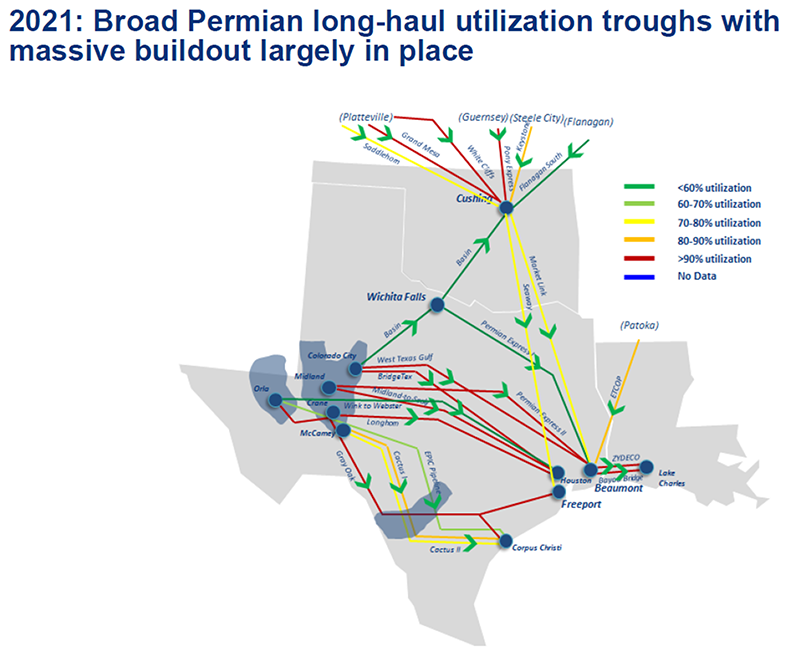

2. Between 2021 and the mid-2030s, Permian basin crude pipeline capacity fills up on routes to export destinations

The new Wood Mackenzie North America Crude Nodal Network shows how northbound Cushing pipelines out of the Permian see utilization pick up due to tightening capacity into all USGC markets. By the mid 2030s, two Permian-to-Corpus Christi crude pipelines will be above 90% utilization, while four delivering into Houston come in higher than 90%. At Beaumont, three inbound crude pipelines will be operating at higher than 90% utilization.

3. Permian basin crude pipeline long-haul capacity will need a slight boost in the early 2030s

A near-term overbuild is expected in the early 2020s. This will see Permian to Gulf Coast pipeline utilization trough at about 82% average utilization and maintain mid-80% range utilization for the rest of the decade. As production growth expands well into the 2030s, another 300,000-500,000 b/d in new capacity will be needed by the early 2030s to meet market demands.

We presented our Permian pipeline forecast findings and more in a recent North America Crude Markets Service webinar. Visit Wood Mackenzie here to access a copy of the slides.